Get Expert Mortgage Guidance and Close Faster

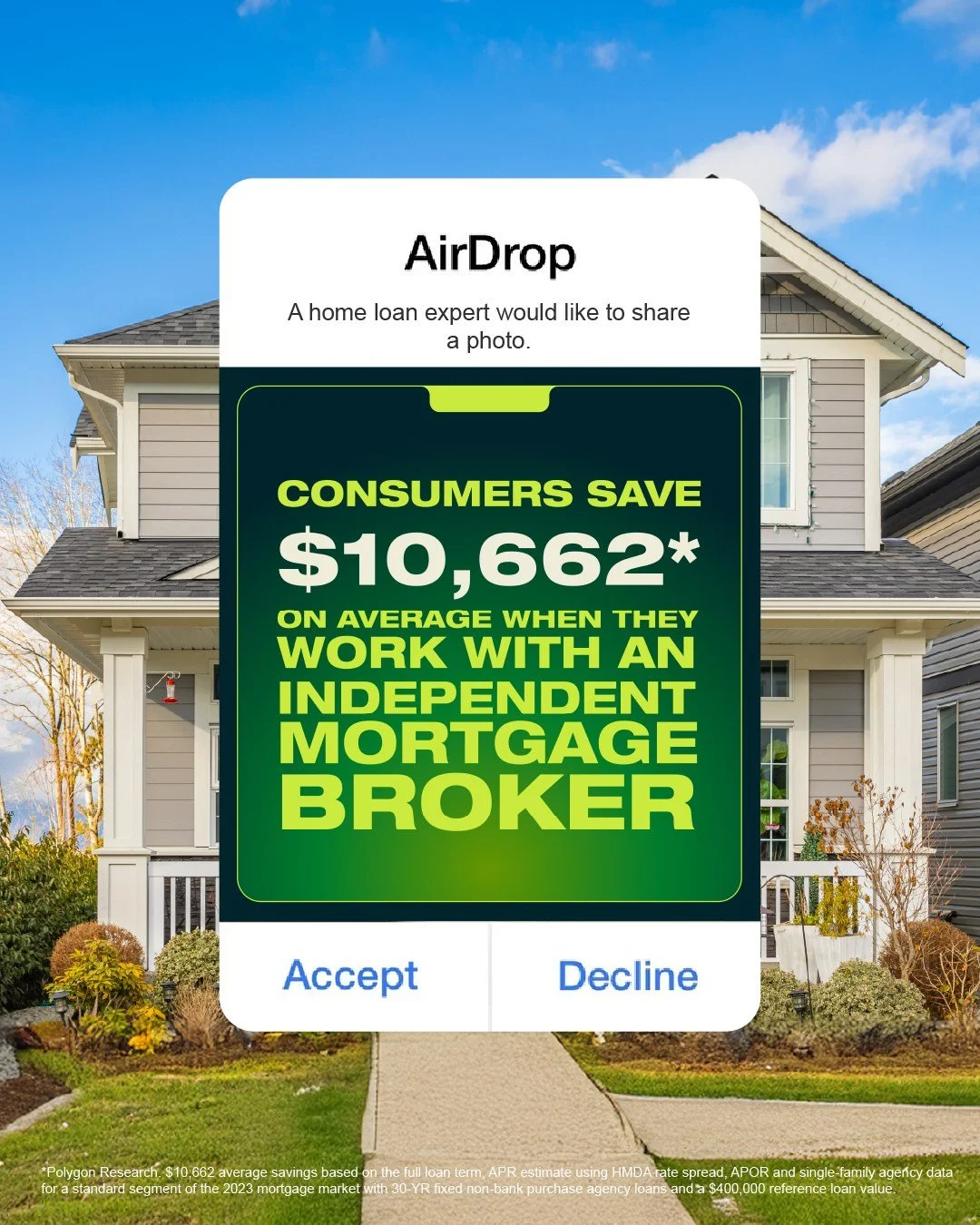

Save thousands on fees, enjoy a streamlined process, and feel confident at every step of your home financing journey.

NMLS# 2234459

Low Fees

Faster Closings

Personalized Support

Loan Programs

Conventional Loan

FHA Loan

USDA Loan

VA Loan

Cash Out Options

Down Payment Assistance

As a dedicated mortgage professional, my mission is to empower you with clear guidance, personalized advice, and a smooth financing experience from start to finish. You get real communication, total transparency, and a partner who treats your financial goals like my own.

Apply in minutes

Answer a few basic questions and get clarity fast.

Step One:

Step Two:

Review options

I walk you through your loan choices and payment

Step Three:

Close with confidence

Enjoy a faster and smoother closing process with expert support.

Follow me on socials

Don't miss out on this valuable resource!

Contact Me

Have a quick question? Interested in working together? Have a question about my referral program? Fill out this basic info and we will be in touch very soon. I can’t wait to hear from you!

FAQs

-

Buying a home is an investment. When you own a home, you can build equity over time, potentially benefit from property value appreciation, and take advantage of tax deductions on mortgage interest and property taxes.

-

This depends on your income, debt, credit score, and the amount of your down payment. It's generally recommended that your monthly mortgage payment should not exceed 28% of your gross monthly income.

-

Pre-qualification is an initial assessment of your financial situation to estimate how much you might be able to borrow. Pre-approval is a more detailed process where the lender verifies your financial information and commits to lending you a specific amount.

-

There are several types of mortgages, including fixed-rate mortgages, adjustable-rate mortgages (ARMs), FHA loans, VA loans, and USDA loans. Each has its own terms, benefits, and eligibility requirements.

-

Item descriptionA down payment is the amount of money you pay upfront when purchasing a home. The required amount varies but typically ranges from 3% to 20% of the home's purchase price.

-

Closing costs are fees associated with finalizing a home purchase, including loan origination fees, appraisal fees, title insurance, and attorney fees. These costs usually range from 2% to 5% of the loan amount

-

Yes, a home inspection is crucial. It helps identify any potential issues with the property before you finalize the purchase, ensuring you are making an informed decision.

-

PMI is insurance that protects the lender if you default on your loan. It is typically required if your down payment is less than 20% of the home's purchase price.

-

The timeline can vary, but it generally takes about 30 to 45 days from the time your offer is accepted to the closing date.

-

Look for an agent with experience, good communication skills, and a solid understanding of the local market. It's also important to choose someone you feel comfortable working with